Delivering Solutions with Technology Edge

In the first post in this series I discussed the enormous growth of the DBMS market in the past 5 years, culminating in a 22.3% rise to nearly $80B in 2021. Then I looked at the nonrelational DBMS pureplay vendors (Aerospike, Couchbase, Datastax, Intersystems, Marklogic, MongoDB, Neo4j and Redis), noting their substantial contribution of $2.3B. Most (75%) of this revenue is attributable to: MongoDB, Intersystems and MarkLogic.

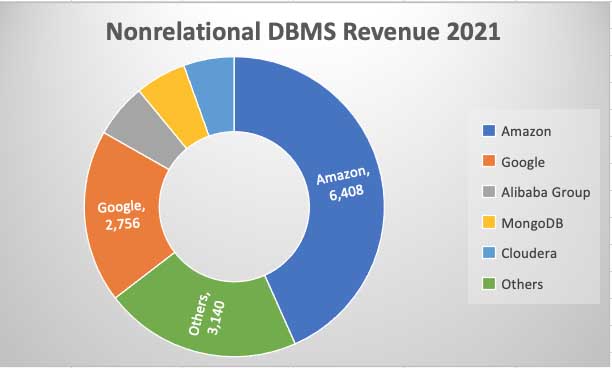

But the pureplays do not tell the big story. Overall, Gartner’s estimate of nonrelational DBMS revenue amounted to $14.8B, or 19% of the DBMS market – up from 8% in 2017. And one vendor dramatically dominates the nonrelational DBMS revenue picture: Amazon Web Services, with $6.4B – over 43% of the total. Google is next with $2.8B – a healthy 18.6%. The next three vendors: Alibaba, MongoDB and Cloudera, collectively contributed another $2.5B and all the remaining vendors another $3.1B.

This remarkable dominance reflects the core trend discussed earlier – the cloud is driving new use cases, and new vendors, to the top of the charts. Much of that activity is happening in nonrelational offerings, and the Cloud DBMS revenue leader – AWS – is making the most of it.

Some of the largest DBMS vendors have been slow to make an impact here: Microsoft crossed the $500M mark with $528M in 2021; IBM is lagging far behind at $52M, and Oracle comes farther down the chart at $27M. But all are now offering nonrelational services in the cloud, pushing:

Not all the players have offerings in all the categories, but their portfolios will expand. In the cloud, it is a portfolio game: customers want choices, and all the vendors are gearing up to give it to them. Collectively, all these participants can be expected to pick up some market share, and the cloud platform providers can be expected to play the biggest role, as Google already has. I expect to see Alibaba ($862M), Huawei ($542M) and Microsoft continue to make strong strides, and IBM and Oracle to pick up the pace.

Copyright 2022 Trends Edge